Introduction: In the intricate landscape of modern financial systems, a pivotal yet often overlooked aspect involves the mechanisms that influence how individuals and entities are evaluated for financial transactions. This section delves into the complex interplay between those who compile and distribute personal data, and the subsequent effects on monetary assessments and digital confidentiality. By examining the practices of these information intermediaries, we aim to shed light on their significance in shaping financial outcomes and safeguarding personal information in the digital realm.

Understanding the Dynamics: At the core of this discussion is the role of entities that specialize in gathering and disseminating various forms of data. These organizations play a crucial part in the process of financial evaluation, Medium impacting everything from eligibility for loans to the terms of credit offerings. Their activities, while essential for financial institutions, also raise significant concerns regarding the protection of sensitive information and the rights of individuals in the digital age.

This exploration will critically assess how these information aggregators operate within the financial ecosystem, influencing decisions that have profound implications for both lenders and borrowers. Furthermore, it will scrutinize the ethical and privacy dimensions associated with these practices, advocating for a balanced approach that respects individual rights while facilitating efficient financial operations.

Understanding Data Brokers in Financial Services

This section delves into the intricate mechanisms by which information intermediaries operate within the financial sector. It explores how these entities gather, analyze, and utilize vast arrays of personal and financial information to facilitate more informed decision-making processes in the realm of monetary transactions.

Information intermediaries, often referred to as data aggregators, play a pivotal role in modern financial services. They collect and compile extensive profiles on individuals, which include but are not limited to, financial history, spending habits, and creditworthiness. This data is then used by various financial institutions to assess risk and make informed decisions regarding loans, credit lines, and other financial products.

- Data Collection: These intermediaries employ sophisticated methods to gather data from multiple sources, including public records, financial transactions, and online activities.

- Data Analysis: The collected data is meticulously analyzed to extract patterns and insights that can predict financial behavior and creditworthiness.

- Data Utilization: The insights derived from the analysis are then used by banks, credit unions, and other financial entities to make informed lending and credit decisions.

The integration of data aggregators into financial services has significantly enhanced the efficiency and accuracy of credit assessments. However, it also raises important questions about the ethical use of personal information and the need for robust regulatory frameworks to protect consumer privacy and rights.

In conclusion, while information intermediaries offer valuable services in the financial sector, it is crucial to balance their benefits with the need for privacy and ethical data usage. This section aims to provide a comprehensive understanding of how these entities operate and the implications of their activities on both financial institutions and consumers.

The Evolution of Credit Scoring Models

Over the years, the methodologies employed by financial institutions to assess borrower eligibility have undergone significant transformations. This section delves into the historical progression and current trends in the algorithms used to evaluate potential debtors, highlighting how these changes have influenced the broader landscape of financial assessments.

Early Models: Initially, these evaluations were based primarily on manual reviews of financial statements and personal interviews. The reliance on subjective criteria often led to inconsistencies in outcomes. However, as technology advanced, so did the tools used for these assessments.

Transition to Automated Systems: The advent of computing power revolutionized the approach. Institutions began to incorporate statistical models that could process larger volumes of information more efficiently. This shift not only increased the speed of assessments but also enhanced their accuracy by reducing human error.

Integration of Alternative Data: More recently, the inclusion of non-traditional data sources has been a game-changer. Information such as utility payments, rental histories, and even social media activity are now being considered. This broader dataset allows for a more nuanced understanding of an individual’s financial behavior and reliability.

Predictive Analytics and Machine Learning: Today, advanced predictive analytics and machine learning algorithms are at the forefront of these assessments. These sophisticated tools can identify patterns and predict future behavior with greater precision than ever before. They are capable of continuously learning and adapting, ensuring that the assessment models remain relevant and effective.

Challenges and Considerations: Despite the advancements, there are ethical and practical considerations that must be addressed. The accuracy and fairness of these models are paramount, and ensuring that they do not inadvertently discriminate against certain groups is a critical concern. Moreover, the balance between leveraging data for better assessments and respecting individual privacy rights is a delicate one that continues to evolve.

In conclusion, the journey of these assessment models from rudimentary tools to complex algorithms reflects a broader trend in the financial sector towards data-driven decision-making. As technology continues to evolve, so too will the methods used to evaluate financial risk, promising even more sophisticated and equitable outcomes.

Impact of Data Aggregation on Lending Practices

This section delves into the profound implications of extensive information compilation on the methodologies employed by financial institutions when extending monetary assistance to individuals. The focus is on how the accumulation of vast amounts of personal details influences the strategies and outcomes in the realm of financial aid provision.

Data Collection and Its Consequences

The gathering of consumer information has become a cornerstone in modern financial analysis. This practice allows institutions to assess risk with greater precision, potentially enhancing the efficiency of resource allocation. However, it also raises significant concerns regarding the protection of individual privacy and the ethical use of personal data.

Privacy and Security Challenges

As more personal data is collected, the risks of unauthorized access and misuse increase. This not only threatens the security of individual information but also undermines trust in financial institutions. The challenge lies in balancing the benefits of enhanced risk assessment with the imperative to safeguard personal privacy.

Regulatory Responses

In response to these concerns, various regulatory frameworks have been established to govern the collection and use of consumer data. These regulations aim to protect individuals from potential exploitation while ensuring that financial institutions can continue to operate effectively. Understanding and complying with these regulations is crucial for maintaining ethical and lawful practices in data usage.

Consumer Awareness and Transparency

Increasing consumer awareness about how their data is used is another critical aspect of this discussion. Transparency from financial institutions regarding data practices can help build trust and ensure that consumers are informed about the implications of their data being used in financial assessments. This transparency is essential for fostering a healthy and informed relationship between consumers and financial service providers.

Privacy Concerns with Consumer Data Collection

This section delves into the intricate regulatory frameworks that oversee the activities of entities involved in the aggregation and utilization of personal information within financial services. It examines how these regulations aim to balance the need for data-driven insights with the protection of individual privacy rights.

As the collection and analysis of consumer information become increasingly prevalent, the need for stringent oversight becomes more critical. Regulatory bodies worldwide have responded by implementing various frameworks to govern how such information is gathered, processed, and used. These frameworks are designed to ensure transparency, fairness, and accountability in the handling of sensitive data.

| Regulatory Body | Key Regulations | Focus Areas |

|---|---|---|

| GDPR (General Data Protection Regulation) | Enhanced rights for data subjects, strict consent requirements, hefty fines for non-compliance | Data protection and privacy for individuals within the EU |

| CCPA (California Consumer Privacy Act) | Right to know, delete, and opt-out of data sales, mandatory disclosures | Consumer privacy rights in California |

| FCA (Financial Conduct Authority, UK) | Guidelines on fair treatment of customers, data protection standards | Ensuring fair practices in financial services |

These regulations not only set standards for data handling but also impose significant responsibilities on entities that process personal information. They require these entities to implement robust data protection measures, conduct regular audits, and maintain comprehensive records of data processing activities. Compliance with these regulations is essential not only for legal reasons but also to build and maintain consumer trust in the financial services sector.

In conclusion, the regulatory frameworks governing the collection and use of consumer data in financial services are complex and evolving. They reflect the ongoing struggle to balance the benefits of data-driven decision-making with the fundamental rights of individuals to privacy and data security.

Regulatory Frameworks Governing Data Brokers

This section delves into the intricate web of rules and regulations that oversee the activities of entities involved in the collection and analysis of personal information within the financial sector. It examines how these frameworks aim to balance the need for accurate assessments with the protection of individual rights and freedoms.

Legislative oversight plays a crucial role in ensuring that practices related to the gathering and utilization of sensitive data adhere to ethical standards. Various statutes and guidelines have been established to govern these activities, aiming to prevent misuse and ensure transparency.

Compliance requirements are stringent, requiring these entities to maintain detailed records of their data processing activities, obtain necessary permissions from data subjects, and implement robust security measures to safeguard the information they handle. These regulations also mandate regular audits and reporting to regulatory bodies, ensuring ongoing accountability.

The impact of these regulatory frameworks extends beyond mere compliance; they shape the ethical landscape of how personal information is used in financial assessments. By setting clear boundaries and expectations, these frameworks help foster trust between consumers and financial institutions, promoting a more equitable and secure financial ecosystem.

In conclusion, the regulatory environment surrounding the use of personal data in financial evaluations is complex and ever-evolving. It is imperative for all stakeholders to stay informed and adapt to the changing legal landscape to uphold ethical standards and protect consumer rights.

Ethical Considerations in Data Usage for Financial Assessments

This section delves into the moral implications associated with the application of information in determining financial eligibility. It explores how the collection and analysis of personal details influence decision-making processes in the financial sector, emphasizing the need for ethical standards to protect individual rights and maintain fairness in financial evaluations.

As technology advances, the methods used to analyze and interpret vast amounts of personal data have become increasingly sophisticated. These advancements not only enhance the precision of financial assessments but also raise significant ethical questions. The following table outlines some of the key ethical considerations in the use of data for financial decisions:

| Aspect | Description | Ethical Consideration |

|---|---|---|

| Data Collection | The gathering of personal information from various sources. | Ensuring consent and transparency in what data is collected and how it is used. |

| Data Accuracy | The reliability and correctness of the data used. | Preventing bias and ensuring that data accurately reflects an individual’s financial status. |

| Data Security | Protecting collected data from unauthorized access or breaches. | Implementing robust security measures to safeguard sensitive information. |

| Data Usage | The application of data in making financial assessments. | Ensuring that data is used fairly and without discrimination, promoting equal access to financial services. |

| Data Retention | The duration for which data is stored. | Limiting data retention to what is necessary and ensuring that outdated or irrelevant data does not influence decisions. |

In conclusion, while technological advancements in data analysis offer significant benefits in enhancing the accuracy and efficiency of financial assessments, they must be accompanied by stringent ethical practices. These practices ensure that the use of personal data respects individual privacy, promotes fairness, and upholds the principles of ethical data management in the financial sector.

Technological Advancements in Data Analysis

This section delves into the transformative developments in the field of data examination, focusing on how these innovations are reshaping the landscape of financial assessments. The advancements discussed here are pivotal in enhancing the precision and efficiency of decision-making processes within the financial sector.

Recent technological breakthroughs have significantly expanded the capabilities of data analysis tools. Here are some key advancements:

- Machine Learning Algorithms: These sophisticated programs can predict outcomes with greater accuracy by learning from patterns in large datasets, thereby improving the reliability of financial forecasts.

- Big Data Processing: The advent of advanced computing power has enabled the handling of vast amounts of information, allowing for more comprehensive and nuanced insights into financial behaviors.

- Predictive Analytics: By utilizing historical data, these tools can forecast future trends and behaviors, aiding in strategic planning and risk management.

- Real-time Data Analysis: The ability to analyze data instantaneously enhances decision-making processes, providing up-to-the-minute insights that are crucial in fast-paced financial environments.

- Data Visualization Techniques: These advancements make complex data more accessible and understandable, facilitating better comprehension and quicker decisions.

The integration of these technologies into financial analysis has not only increased the speed and accuracy of assessments but also opened new avenues for innovation and improvement in financial services. As these tools continue to evolve, they promise to further refine the methodologies used in financial evaluations, leading to more robust and reliable outcomes.

Consumer Awareness and Data Broker Transparency

In this section, we delve into the critical aspects of how individuals are becoming more informed about the activities of certain intermediaries in the financial sector and the subsequent transparency of these entities. This awareness is pivotal in fostering trust and ensuring ethical practices in the realm of financial assessments.

Transparency is a cornerstone in the relationship between consumers and financial intermediaries. It involves the clear disclosure of how personal information is utilized and the purposes it serves in financial evaluations. This openness helps in mitigating concerns related to the misuse of sensitive data and enhances the credibility of the processes involved.

Consumer education plays a significant role in this context. As individuals become more knowledgeable about the mechanisms through which their data is collected and analyzed, they are better equipped to make informed decisions about their financial engagements. This empowerment is not only beneficial for personal financial management but also contributes to a more accountable and fair financial ecosystem.

Furthermore, the regulatory frameworks that govern these practices are continuously evolving to meet the demands of transparency and consumer protection. These frameworks ensure that intermediaries adhere to strict guidelines regarding data handling and disclosure, thereby safeguarding consumer interests.

In conclusion, the interplay between consumer awareness and the transparency of financial intermediaries is crucial in maintaining a balanced and ethical financial environment. As technology advances and data usage becomes more sophisticated, it is imperative that these principles are upheld to protect consumer rights and foster a trustworthy financial sector.

Case Studies: Successful Integration of Data Brokers

This section delves into real-world examples where intermediaries have effectively merged with financial institutions to enhance decision-making processes. By examining these instances, we can gain insights into the practical applications and benefits of such collaborations, highlighting how they streamline operations and improve outcomes.

| Company | Integration Strategy | Outcome |

|---|---|---|

| FinCorp | Utilized third-party information to augment internal assessments, focusing on risk management and customer segmentation. | Significant reduction in default rates and enhanced targeting of promotional offers. |

| BankTrust | Implemented a comprehensive data analysis tool provided by an external vendor to refine loan approval processes. | Improved efficiency in loan processing times and increased approval rates for small businesses. |

| SecureLend | Partnered with a data specialist to enhance fraud detection mechanisms, integrating real-time data feeds. | Enhanced security measures led to a decrease in fraudulent activities and increased customer trust. |

These case studies illustrate the pivotal role that strategic partnerships with information intermediaries can play in modern financial operations. By leveraging external data and analytics, financial entities can optimize their services, mitigate risks, and better serve their clientele. The success of these integrations underscores the importance of adapting to technological advancements and embracing collaborative approaches in the financial sector.

Future Trends in Data-Driven Financial Decisions

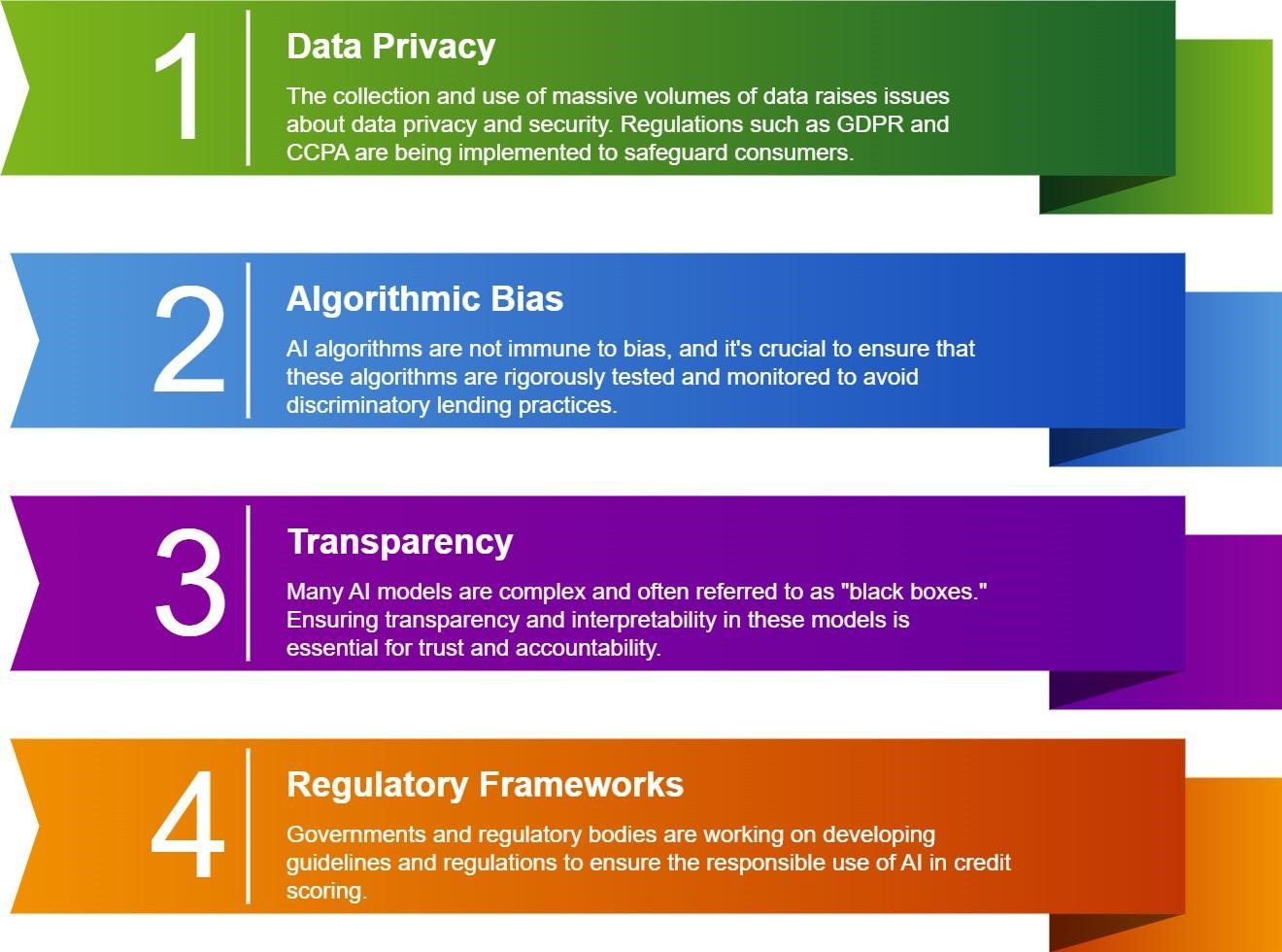

As we advance, the integration of sophisticated analytics into monetary assessments is poised to transform traditional practices. This section delves into emerging patterns that are likely to shape the landscape of fiscal evaluations, emphasizing innovation and adaptation in response to technological advancements and regulatory shifts.

Several key trends are anticipated to dominate the future of this sector:

- Increased reliance on artificial intelligence and machine learning to refine predictive models, enhancing accuracy and efficiency in decision-making processes.

- Expansion of blockchain technology to ensure transparency and security in data transactions, mitigating risks associated with fraudulent activities.

- Greater emphasis on ethical considerations, particularly in the collection and use of personal information, leading to more stringent guidelines and consumer protections.

- Development of personalized financial strategies through granular data analysis, enabling tailored solutions that better meet individual needs and preferences.

- Enhanced collaboration between financial institutions and tech companies, fostering innovation and the rapid adoption of cutting-edge technologies.

- Growing importance of data privacy laws and regulations, influencing the way organizations handle and protect sensitive information.

- Shift towards real-time data processing, allowing for immediate adjustments and responses to market changes, thereby optimizing financial outcomes.

- Emergence of new metrics and indicators beyond traditional creditworthiness assessments, incorporating broader socio-economic factors to provide a more holistic view of financial health.

These trends collectively highlight a dynamic shift towards more sophisticated, responsive, and ethical practices in the realm of financial evaluations. As technology continues to evolve, it is crucial for stakeholders to stay informed and adaptable, ensuring they can leverage these advancements to their advantage while safeguarding the interests of all parties involved.